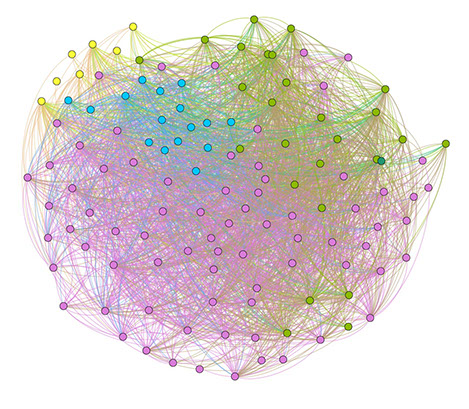

Financial contagion from liquidity shocks has recently been recognized as a prominent driver of systemic risk in interbank lending markets. When one bank experiences liquidity problems, it may be unable to fulfill obligations to other banks, potentially triggering a cascade of failures throughout the financial system. Understanding and modeling these contagion dynamics is crucial for financial stability and regulatory policy.

Building on standard compartment models used in epidemiology, we develop an EDB (Exposed-Distressed-Bankrupted) model for the dynamics of liquidity shock reverberation between banks. This epidemiological framing is natural: liquidity distress spreads through financial networks much like infectious diseases spread through social networks, with transmission occurring through direct exposures (interbank loans) and susceptibility varying by institution.